Just Take note that In case you are a company operator and contributing to your personal SEP IRA, it's essential to lead the same proportion to your entire personnel’ SEP IRAs. Contributions created by your business may be deducted from taxes.

The non-Doing work wife or husband can open up a conventional or Roth IRA in their own personal name and make contributions based mostly on their own residence income. Ordinarily, that you are restricted to contributing the amount you

This technique is utilized to help sleek out the peaks and valleys designed by market volatility. The reasoning driving this strategy is to cut down your investment risk by investing the identical amount of money about a length of time.

Their goal is to help you individuals and households navigate life's greatest decisions with the steerage in their financial experts.

Find out the very best 21 metal production companies during the US, specializing in precision machining, fabrication, and reducing applications. Learn the way PCC Structurals and Kennametal are top the industry.

And, as opposed to other retirement plans, annuities aren’t matter to IRS contribution restrictions, so that you can devote around you desire to your potential.

Should your employer offers a plan that may help you help you save for retirement, you must Pretty much unquestionably choose-in because they can really make it easier to jumpstart your retirement savings. But in which you get the job done will affect what sort of retirement options you've.

Real estate funds Real-estate funds, such as real estate investment trusts (REITs), may Participate in a check task in diversifying your portfolio and providing some protection against the risk of inflation.

American Century is a financial services firm that offers investment products and solutions. They provide an array of mutual funds and ETFs site here for individual traders, and different accounts and subadvisory services for institutional shoppers.

If your once-a-year income isn’t way too substantial, a Roth IRA is among the finest retirement accounts out there. When your Roth IRA contributions aren’t tax-deductible now, you don’t have to spend income taxes over the withdrawals you make once you retire.

This blended inventory/bond portfolio is noted for having moderate risk and building reasonable returns.

By introducing some preset-income solutions, you will be even further hedging your portfolio against market volatility and uncertainty. These funds attempt to match the general performance of broad indexes, so as an alternative to investing in a particular sector, they struggle to mirror the bond market's value.

LPL is actually a financial services business that specializes in building custom-made financial plans tailor-made to individual requirements. more They supply in depth financial planning solutions and prioritize constructing lengthy-term relationships with their clientele.

Because young buyers have longer investment time horizons, which give their portfolios more time to get better from stock dips, they can allocate bigger percentages of their portfolios to stocks.

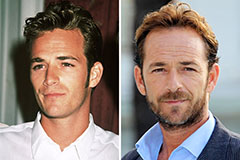

Luke Perry Then & Now!

Luke Perry Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!