In case your insurance company performs well inside a yr, you’re entitled to experience the benefits and acquire dividends.

Analysis has demonstrated that the majority wealth is misplaced by the 2nd generation, which implies that inheritors are certainly not as professional as their predecessors about how to maintain the worth of the assets they obtain.

A toddler or member of the family might not need to just take over the business, and finding a person new to consider about is often harder than you anticipate.

When intraday market volatility rises to lofty degrees, that sort of selling price motion might be ample to frighten any investor. But for anyone who is location your sights various several years or many years down the road, what occurs currently shouldn't make any difference for you all of that Considerably.

This gets to be all the more crucial in retirement when investments that are unsuccessful to help keep speed with inflation provide significantly less real worth in your foreseeable future desires.

e., assets whose benefit is especially derived from physical Attributes such as commodities) for instance All those whose revenues are expected to enhance with inflation without corresponding boosts in expenses."

Vanguard provides a cost-free Investor Questionnaire to help you establish your chance tolerance. According to the answers you present Vanguard will suggest one among 9 asset allocations. It is possible to then Construct your portfolio determined by These allocations with the investment broker of the decision.

Supplying ahead of Dying, if at all possible, can open up enriching new bonding options, like a grandparent getting their grandchild their first automobile or purchasing their school tuition.

Insurance policy may help mitigate hazards, but intense saving and very well-calibrated investing are essential pillars of wealth preservation.

Even so, gold isn't a true great hedge against inflation. When inflation rises, central banking companies have a tendency to improve desire rates as A part of financial plan.

This is straightforward to complete in the event you take part in an employer-sponsored retirement prepare. Typical contributions right into a 401(k) or equivalent plan are easy and automated.

Having a balanced unexpected emergency savings fund allows, but thinking about insurance coverage along with other possibility management options may also offer some “just just in case” cushion.

You've got a numerous set of applications and strategies to work with. Prior to deciding to learn how to use them, be sure my website you're picking out the right ones.

Without a Basis to abide by, an unanticipated expense or unforeseen loss could involve dipping into extensive-expression investments to protect shorter-term desires.

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Dylan and Cole Sprouse Then & Now!

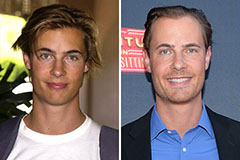

Dylan and Cole Sprouse Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!